MoneyWeek is a weekly magazine that enables you to become a better-informed, smarter investor and enjoy the rewards of managing your money with confidence. Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor...

Anti-tourist activists target Amazon’s boss

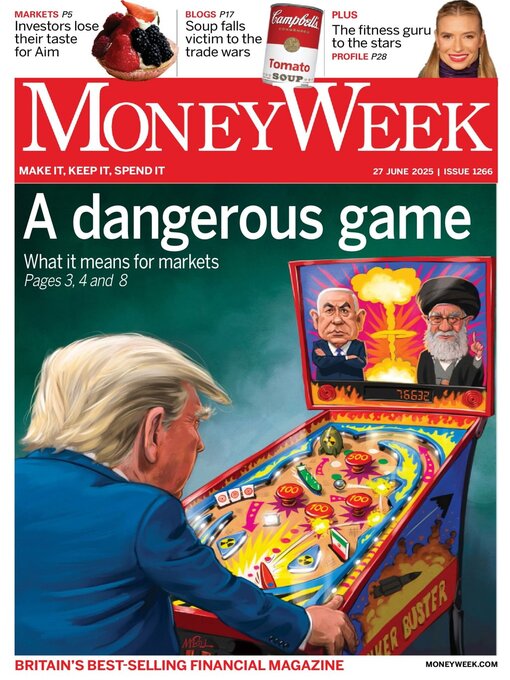

Investors remain calm as war unfolds • Conflict in the Middle East has failed to shake oil or stockmarkets. Can the peace hold?

Don’t expect fast rate cuts

Aim has missed its target

Viewpoint

■ Zero-interest rates return

AI partnership on the rocks • Microsoft’s joint venture with Open AI, the developer of ChatGPT, appears to be in trouble. What now for the two groups? Matthew Partridge reports

Tesla’s robotaxis take to the road

Berkeley’s shaky foundations

MoneyWeek’s comprehensive guide to this week’s share tips

A German view

IPO watch

Israel victorious in the “12-Day War” • What comes next depends on what happens internally in Iran. Emily Hohler reports

Labour unveils its industrial strategy

News

The welcome end of the “fleecehold” • Britain’s feudal system of property ownership is being overhauled. About time, says Simon Wilson

It makes no sense to shun the US • Manufacturers and investors have pivoted away from the world’s biggest economy. That’s a mistake

City talk

Rushing to sell at a discount • Persistent discounts seem to be making boards too hasty about backing opportunistic offers

I wish I knew what discounted cash flow was, but I’m too embarrassed to ask

Guru watch

Best of the financial columnists

Money talks

Soup falls victim to the trade wars

The economics of slavery

Wisdom from the Karate Kid

The decline of trust in Britain

Profitable private equity • Investment trusts offer access to enticing opportunities in global unlisted firms and assets. For highly experienced investors with plenty of money, there is another way in, says David Prosser

Debt funds have their day in the sun • Investors can now earn equity-like returns from debt and with less risk, says Rupert Hargreaves

Find managers worth paying for • Active funds are unlikely to beat a cheap tracker on average, but can be valuable in certain markets

Activist watch

Short positions... two European trust mergers

How to make a few billion dollars • The boss of QXO knows how, and aims to repeat the trick. Investors would be wise to back him

Savings caught in IHT net • Pensions will be subject to inheritance tax from 2027. Start preparing now

A top-up for the self-employed

News in brief... new winter-fuel scams

Dunelm has done well • The home furnishings retailer has proved resilient and looks inexpensive

Betting on politics... a vote in New Jersey

How my tips have fared

Gas infrastructure companies will provide a lift for your portfolio • A professional investor tells us where she’d put her money. This week: Stacey Morris, Head of Energy Research at VettaFi, highlights three stocks

Alex

The fitness guru to the stars • Celebrity trainer Tracy Anderson counts Gwyneth Paltrow and Madonna among her clients and she has built a personal fortune estimated at $110m. But can she stop the copycats? Jane Lewis reports

“The thinking person’s fiscal crumpet”

Fun and sun off Antigua • The...

Issue 1266

Issue 1266

Issue 1265

Issue 1265

Issue 1264

Issue 1264

Issue 1263

Issue 1263

Issue 1261-1262

Issue 1261-1262

Issue 1260

Issue 1260

Issue 1259

Issue 1259

Issue 1258

Issue 1258

Issue 1257

Issue 1257

Issue 1256

Issue 1256

Issue 1255

Issue 1255

Issue 1254

Issue 1254

Issue 1253

Issue 1253

Issue 1252

Issue 1252

Issue 1251

Issue 1251

Issue 1250

Issue 1250

Issue 1249

Issue 1249

Issue 1248

Issue 1248

Issue 1246-1247

Issue 1246-1247

Issue 1245

Issue 1245

Issue 1244

Issue 1244

Issue 1243

Issue 1243

Issue 1242

Issue 1242

Issue 1240-1241

Issue 1240-1241